|

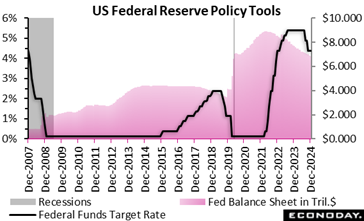

The Fed policy announcement in the week past matched expectations for no rate change but markets judged the accompanying statements as somewhat hawkish. As a result, expectations for rate cuts this year were marked down slightly.

Fed Chair Jerome Powell said the FOMC is in no hurry to adjust rates with the economy and monetary policy in a very good place. Meeting shortly after President Trump demanded rate cuts, the FOMC left the door open to a resumption of monetary easing but gave the impression that the rate pause would continue. Powell said the FOMC will need to see further progress in reducing inflation toward the Fed’s target, although he said the emergence of unexpected weakness in the labor market could cause the FOMC to ease sooner.

Powell, in his post-FOMC press conference, reiterated that it is appropriate for the FOMC to proceed slowly given that the federal funds rate is closer to neutral after 100 basis points of rate cuts in late 2024 and given that inflation remains “elevated.” At the same time, Powell said he and his colleagues will be paying close attention to labor market conditions, not wanting to see further cooling of employment.

The FOMC, in a unanimous vote, left the federal funds rate in a target range of 4.25 percent to 4.50 percent after lowering its policy rate three times from September through December. As usual, it said future rate moves would be data-dependent.

In connection with the Fed balance sheet, the FOMC reiterated that it will continue reducing its holdings of Treasury securities and agency debt and agency mortgage backed securities. This means the Fed will continue to roll off $25 billion of maturing Treasury securities and $35 billion of agency debt and agency mortgage backed securities per month.

Powell gave no indication when the Fed might stop shrinking its bond portfolio but suggested here again there is no hurry. “Reserves are still abundant,” he said. “They remain roughly as high as when runoff began.” He said the Fed will be “monitoring a range of indicators” to determine when to stop shrinking the balance sheet.

The second major event in the past week, the first look at GDP for the fourth quarter, showed growth at 2.3 percent, below expectations for 2.6 percent, and down from 3.1 percent in Q3. The slower growth relative to Q3 reflected weaker investment, especially business fixed investment, and a negative contribution from net exports. On the positive side, personal consumption came in better than expected with growth at 4.2 percent, which topped expectations for 3.1 percent.

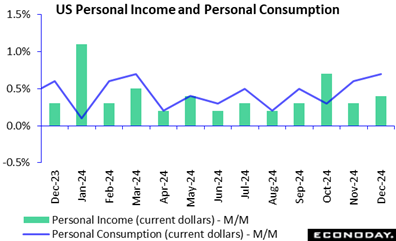

Finally, US personal income was reported up by 0.4 percent in December, compared to a 0.3 percent increase in November and matching expectations for a 0.4 percent rise in the Econoday survey of forecasters. Consumer spending ramped up by 0.7 percent last month to top expectations for a 0.5 percent increase. That followed a revised 0.6 percent increase in November (previously reported at +0.4 percent).

As for the Fed's preferred inflation gauge, the PCE price index rose 0.3 percent on a monthly basis in December, picking up the pace after a 0.1 percent rise in November and a 0.2 percent uptick in October. Prices for goods rose 0.2 percent and prices for services increased 0.3 percent. Food prices increased 0.2 percent and energy prices jumped by 2.7 percent. Excluding food and energy, the PCE price index increased 0.2 percent, following the 0.1 percent rise in November.

Compared to a year ago, the December PCE price index rose 2.6 percent after a 2.4 increase in November. Prices for goods were unchanged and prices for services jumped 3.8 percent. The core PCE price index is up 2.8 percent from December 2023, matching November's year-over-year increase.

Annual PCE price inflation has now been stuck around the 2.8 percent mark for the previous three months, backing up the FOMC's assessment that inflation "remains somewhat elevated." Coupled with the inflationary risk posed by looming punitive tariffs, this gives the Fed even more reason to remain on hold.

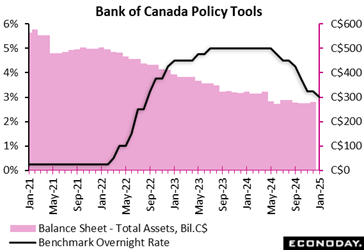

The Bank of Canada trimmed its policy interest rate – the target for overnight lending rates – by a more gradual pace of 25 basis points to 3.0% in a pre-emptive move to help shield the economy from the threat of stiff tariffs on its exports to the United States. It follows two consecutive large-size 50-basis point cuts, in December and October, and three 25-basis point cuts since June when the bank began unwinding the effects of its past aggressive tightening. It has now delivered a total 200 basis points (2.0 percentage points) in credit easing in just seven months. The Bank of Canada trimmed its policy interest rate – the target for overnight lending rates – by a more gradual pace of 25 basis points to 3.0% in a pre-emptive move to help shield the economy from the threat of stiff tariffs on its exports to the United States. It follows two consecutive large-size 50-basis point cuts, in December and October, and three 25-basis point cuts since June when the bank began unwinding the effects of its past aggressive tightening. It has now delivered a total 200 basis points (2.0 percentage points) in credit easing in just seven months.

The bank also announced its plan to complete the normalization of its balance sheet, ending quantitative tightening. It will restart asset purchases in early March, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy.

"The cumulative reduction in the policy rate since last June is substantial," the bank said, repeating its recent view. "Lower interest rates are boosting household spending and, in the outlook published today, the economy is expected to strengthen gradually and inflation to stay close to target."

"However, if broad-based and significant tariffs were imposed, the resilience of Canada's economy would be tested," the bank said.

Governor Tiff Macklem told a news conference that the U.S. trade policy is a major source of uncertainty and that there are many possible scenarios: It is not certain what new tariffs will be imposed, when or how long they will last. Nobody knows the scope of retaliatory measures or what fiscal supports will be provided.

"Having restored low inflation and reduced interest rates substantially, monetary policy is better positioned to help the economy adjust to new developments," the governor said. "As always, the bank will be guided by our monetary policy framework and our commitment to maintain price stability over time."

Asked whether reviving quantitative easing (buying large sums of government bonds and other financial assets) is the cards to ward off what could be a severe negative impact of the Trump tariffs, the government responded in a firm tone: "We are a long way from needing quantitative easing." In the bank's recent review of its own usage of QE during the pandemic, "What we concluded was that the bar for using quantitative easing in Canada has always been very high, and in fact we've only used it once."

The U.S. Federal Reserve stood pat on interest rates as it continues to bring inflation back down to its 2% target from just under 3%, defying the request made last week by President Donald Trump to cut rates. The U.S. Federal Reserve stood pat on interest rates as it continues to bring inflation back down to its 2% target from just under 3%, defying the request made last week by President Donald Trump to cut rates.

After a two-day meeting, the Federal Open Market Committee announced that it decided in a unanimous vote to maintain the target range for the federal funds rate in a range of 4.25% to 4.50%, as widely expected.

The Fed still sees economic activity as expanding "at a solid pace" while noting that the unemployment rate has stabilized at a low level in recent months, and that labor market conditions "remain solid." The FOMC repeated that inflation "remains somewhat elevated."

The committee judges that the risks to achieving its employment and inflation goals are "roughly in balance." In the face of the uncertain economic outlook, the FOMC said it is attentive to both sides of its dual mandate.

"In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks," it said, repeating its December statement.

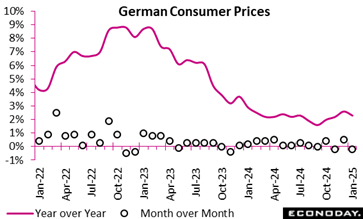

Germany's annual inflation rate fell from 2.6 percent in December 2024 to 2.3 percent in January. This suggests that while inflation persists, it remains slightly above the target of 2 percent, influenced by stabilising supply chains and cautious consumer spending. However, the 0.2 percent decline from December 2024 signals a short-term price correction, possibly reflecting seasonal factors such as post-holiday demand dips. Germany's annual inflation rate fell from 2.6 percent in December 2024 to 2.3 percent in January. This suggests that while inflation persists, it remains slightly above the target of 2 percent, influenced by stabilising supply chains and cautious consumer spending. However, the 0.2 percent decline from December 2024 signals a short-term price correction, possibly reflecting seasonal factors such as post-holiday demand dips.

The harmonised index of consumer prices at 2.8 percent year-over-year presents a slightly higher inflation measure, aligning with broader European trends. More notably, core inflation at 2.9 percent, hints at underlying price pressures. While inflation appears controlled, policymakers may remain vigilant, balancing the need for price stability with economic growth.

If this trend continues, the ECB remains on track to cut rates further in the coming months, but in a gradual and limited way, taking the policy rate to 2 percent by year-end. This signals that consumers and businesses may experience a relatively stable cost environment in 2025, barring unexpected shocks.

The ECI matched expectations with a 0.9 percent rise in the fourth quarter from the third quarter, up slightly from 0.8 percent in the third quarter from the second. It is up 3.8 percent from a year ago versus 3.9 percent in the third quarter. The results are not startling but point to stability in employment costs rather than the kind of easing in cost pressures the Fed might desire. The ECI matched expectations with a 0.9 percent rise in the fourth quarter from the third quarter, up slightly from 0.8 percent in the third quarter from the second. It is up 3.8 percent from a year ago versus 3.9 percent in the third quarter. The results are not startling but point to stability in employment costs rather than the kind of easing in cost pressures the Fed might desire.

In the fourth quarter, wages and salaries – about two-thirds of the compensation index -- are up 0.9 percent compared to the third quarter and up 3.8 percent year-over-year. That compares with 0.8 percent and 3.9 percent, respectively in Q3. Benefits costs are 0.8 percent higher compared to the prior quarter and up 3.6 percent year-over-year versus 0.8 percent and 3.7 percent in Q3.

The latest GDP flash estimate signals a stall in economic momentum in the euro area, with seasonally adjusted GDP remaining flat in the fourth quarter of 2024, following a 0.4 percent expansion in the third quarter. This update, about 0.2 percentage points below the consensus, suggests that growth drivers may be losing momentum, potentially due to uncertainties. The latest GDP flash estimate signals a stall in economic momentum in the euro area, with seasonally adjusted GDP remaining flat in the fourth quarter of 2024, following a 0.4 percent expansion in the third quarter. This update, about 0.2 percentage points below the consensus, suggests that growth drivers may be losing momentum, potentially due to uncertainties.

However, on a year-over-year basis, GDP still managed a 0.9 percent increase, matching the third quarter's performance and just 0.1 percent below the consensus forecast. This stability implies that while short-term momentum has softened, the broader economic trajectory remains positive, supported by resilient consumer spending and investments. The stagnation in the fourth quarter could signal headwinds for 2025, particularly if high interest rates, inflationary pressures, or global trade frictions persist.

Moving forward, policymakers will likely assess the need for supportive fiscal or monetary measures to prevent stagnation from turning into contraction, while businesses and investors may need to adjust strategies to navigate an increasingly uncertain economic landscape.

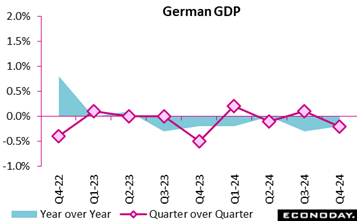

The latest GDP figures for Germany paint a picture of an economy grappling with both cyclical and structural challenges. The 0.2 percent decline in the fourth quarter of 2024, both quarter-over-quarter and year-over-year (price and calendar-adjusted), and 0.1 percent below the consensus suggests stagnation rather than sharp contraction. The latest GDP figures for Germany paint a picture of an economy grappling with both cyclical and structural challenges. The 0.2 percent decline in the fourth quarter of 2024, both quarter-over-quarter and year-over-year (price and calendar-adjusted), and 0.1 percent below the consensus suggests stagnation rather than sharp contraction.

Notably, private and government consumption provided some resilience, preventing a deeper downturn. However, exports suffered a significant decline, a reflection of weakening global demand. This signals potential competitiveness issues affecting Germany's export-driven economy.

The overall annual GDP contraction of 0.2 percent reinforces the view of a sluggish economic landscape. While the decline is marginal, it marks a second consecutive weak performance for Europe's largest economy, following similar struggles in previous quarters. The fewer working days in 2024 contributed to the softer year-over-year contraction, but underlying demand dynamics remain weak.

This trend raises concerns about structural headwinds, including demographic shifts, high energy costs, and geopolitical uncertainties. To reignite growth, Germany may need targeted investments in productivity, innovation, and economic diversification, alongside policies fostering resilience in key industries.

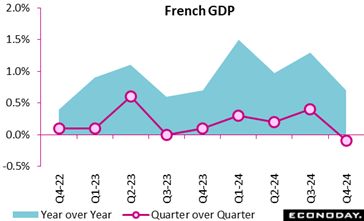

The French economy contracted slightly in the fourth quarter of 2024 (minus 0.1 percent), marking a slowdown after the 0.4 percent growth in the third quarter, which the Paris Olympic and Paralympic Games had buoyed. The post-event economic cooldown, typical after large-scale international events, underscores the transient nature of such economic boosts. The French economy contracted slightly in the fourth quarter of 2024 (minus 0.1 percent), marking a slowdown after the 0.4 percent growth in the third quarter, which the Paris Olympic and Paralympic Games had buoyed. The post-event economic cooldown, typical after large-scale international events, underscores the transient nature of such economic boosts.

Household consumption remained resilient (0.4 percent), though it decelerated from third-quarter levels, reflecting cautious spending patterns. Investment activity remained weak, with gross fixed capital formation stabilising (minus 0.1 percent), suggesting businesses exercised restraint amid economic uncertainties.

Trade dynamics continued to weigh on growth, with exports declining (minus 0.2 percent) while imports rebounded (0.4 percent), resulting in a negative foreign trade contribution (minus 0.2 points). This indicates a softening of external demand and increased reliance on imports, possibly driven by restocking ahead of regulatory or market shifts.

Overall, the fourth quarter's contraction reflects a recalibration following an event-driven surge, highlighting the importance of sustainable economic policies beyond one-off global events.

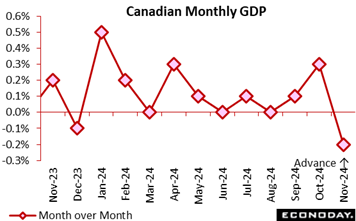

GDP was down 0.2 percent in November from October, worse than the expected 0.1 percent decline, following an unrevised rise of 0.3 percent in October. The advance estimate for December calls for an increase of 0.2 percent. GDP was down 0.2 percent in November from October, worse than the expected 0.1 percent decline, following an unrevised rise of 0.3 percent in October. The advance estimate for December calls for an increase of 0.2 percent.

The latest report featured contraction in 13 of 20 sectors, showing broad-based weakness, and the 0.2 percent loss was biggest in a month since December 2023. There was a contraction of 0.6 percent in goods-producing industries and a 0.1 percent decline in services.

U.S. personal income rose by 0.4 percent in December, compared to a 0.3 percent increase in November and matching expectations for a 0.4 percent rise in the Econoday survey of forecasters. Consumer spending, as measured by the Personal Consumption Expenditures (PCE) index, ramped up by 0.7 percent last month following a revised 0.6 percent increase in November (previously +0.4 percent). U.S. personal income rose by 0.4 percent in December, compared to a 0.3 percent increase in November and matching expectations for a 0.4 percent rise in the Econoday survey of forecasters. Consumer spending, as measured by the Personal Consumption Expenditures (PCE) index, ramped up by 0.7 percent last month following a revised 0.6 percent increase in November (previously +0.4 percent).

As for the Federal Reserve's preferred inflation gauge, the PCE price index rose 0.3 percent on a monthly basis in December, picking up the pace after a 0.1 percent rise in November and a 0.2 percent uptick in October. Prices for goods rose 0.2 percent and prices for services increased 0.3 percent. Food prices increased 0.2 percent and energy prices jumped by 2.7 percent. Excluding food and energy, the PCE price index increased 0.2 percent, following the 0.1 percent rise in November.

Compared to a year ago, the December PCE price index rose 2.6 percent after a 2.4 increase in November. Prices for goods were unchanged and prices for services jumped 3.8 percent. The core PCE price index is up 2.8 percent from December 2023, matching November's year-over-year increase.

Annual PCE price inflation has now been stuck around the 2.8 percent mark for the previous three months, backing up the FOMC's assessment that inflation "remains somewhat elevated." Coupled with the inflationary risk posed by looming punitive tariffs, this gives the Fed even more reason to remain on hold for the next few months.

Monday, the PMI manufacturing finals are expected to have no revisions from the flash across France, Germany, the Eurozone area, the United Kingdom and the United States. France is expected to post 45.3, Germany 44.1, Eurozone 46.1, the United Kingdom 48.2 and the United States 50.1.

Tuesday, US JOLTS are expected to have job openings pretty flat at 8.00 million in December.

Wednesday, the PMI composite is also expected to show no change in Germany. Germany’s composite is expected to be 50.1 and 52.5 for services while the United States PMI services is expected to be 52.8.

Thursday, the United Kingdom’s Bank of England is expected to announce a 25 basis point rate cut to 4.5 percent as the economy is stalling. Forecasters expect the BOE to signal more rate cuts ahead as the bank updates its economic forecasts.

Also, the United States productivity and costs first estimate for the fourth quarter is expected to show an annual gain of 1.8 percent compared with 2.2 percent in Q3. Unit labor costs are seen up 3.3 percent versus 0.8 percent in Q3.

Friday, Japan's real household spending is forecast to post a fifth straight drop in December, down 0.3 percent on year, as flat growth in real wages amid elevated costs for food and other necessities continued squeezing consumers, following a 0.4 percent dip in November. Lower temperatures supported demand for winter clothing. Forecasts range widely from a 1.0 percent drop to a 1.5 percent gain. On the month, real average expenditures by households with two or more people are expected to fall 1.4 percent after edging up 0.4 percent in November, surging 2.9 percent in October and slumping 1.3 percent in September.

South Korea Industrial Production for December (Mon 0800 KST; Sun 2300 GMT; Sun 1800 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.4%

The consensus sees industrial production up a sluggish 0.1 percent on the month in December, not impressive after a decline of 0.7 percent in November.

Australia Retail Sales for December (Mon 1100 AET; Mon 0000 GMT; Sun 1900 EST)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -1.2% to 0.8%

After two strong months in October and November, sales faltered in December with expectations for a decline of 0.3 percent on the month.

China PMI Manufacturing for January (Mon x CET; Mon x GMT; Sun 2045 EST)

Consensus Forecast, Level: 50.6

Consensus Range, Level: 50.5 to 50.8

The consensus looks for a tiny improvement to 50.6 in January from 50.5 in December.

France PMI Manufacturing Final for January (Mon 0950 CET; Mon 0850 GMT; Mon 0350 EST)

Consensus Forecast, Level: 45.3

Consensus Range, Level: 45.3 to 45.3

No revision from the 45.3 flash is the call for PMI manufacturing final.

Germany PMI Manufacturing Final for January (Mon 0955 CET; Mon 0855 GMT; Mon 0355 EST)

Consensus Forecast, Level: 44.1

Consensus Range, Level: 44.1 to 44.1

Forecasters look for no revision in the final report from the flash at 44.1.

Eurozone PMI Manufacturing Final for January (Mon 1000 CET; Mon 0900 GMT; Mon 0400 EST)

Consensus Forecast, Level: 46.1

Consensus Range, Level: 46.1 to 46.1

The call is no revision from the flash at 46.1.

United Kingdom PMI Manufacturing Final for January (Mon 0930 GMT; Mon 0430 EST)

Consensus Forecast, Level: 48.2

Consensus Range, Level: 48.2 to 48.2

No revision from the 48.2 flash is the call for PMI manufacturing final.

Eurozone HICP Flash for January (Mon 1100 CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast, HICP - Y/Y: 2.5%

Consensus Range, HICP - Y/Y: 2.3% to 2.7%

Consensus Forecast, Narrow Core - Y/Y: 2.7%

Consensus Range, Narrow Core - Y/Y: 2.6% to 2.7%

Eurozone headline inflation is seen pretty flat with HICP up 2.5 percent and core at 2.7 percent in the latest month versus 2.4 percent and 2.7 percent a month ago.

United States North American-made Vehicle Sales for January SAAR (Mon)

Consensus Forecast,: 16.2 M

Consensus Range: 15.9 M to 16.6 M

Sales are seen down slightly at 16.2 million versus 16.8 million in December.

United States PMI Manufacturing Final for January (Mon 0945 EST; Mon 1445 GMT)

Consensus Forecast, Index: 50.1

Consensus Range, Index: 49.8 to 50.1

No revision from the flash at 50.1 is the call.

United States ISM Manufacturing Final for January (Mon 1000 EST; Mon 1500 GMT)

Consensus Forecast, Index: 49.5

Consensus Range, Index: 48.3 to 51.6

Manufacturing remains in the doldrums with expectations for marginal contraction at 49.5 in January versus 49.3 in December and 48.4 in November.

United States Construction Spending for December (Mon 1000 EST; Mon 1500 GMT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: -0.1% to 1.1%

The consensus looks for another moderate uptick of 0.3 percent for December from November.

United States Factory Orders for December (Tue 1000 EST; Tue 1500 GMT)

Consensus Forecast, M/M: -0.6%

Consensus Range, M/M: -1.1% to 0.5%

A weak durable goods figure, down 2.2 percent in December on a drop in transportation orders, translates to an expected decline of 0.6 percent for factory orders.

United States JOLTS for December (Tue 1000 EST; Tue 1500 GMT)

Consensus Forecast, Job Openings: 8.00 M

Consensus Range, Job Openings: 7.80 M to 8.14 M

Just when we thought conditions were finally easing up in the labor market, openings rose to a surprising 8.098 million in November from 7.839 million in October. Forecasters expect job openings pretty flat at 8.00 million in December. Openings were down at 7.372 million in September.

New Zealand Labour Market Conditions for Fourth Quarter (Wed 1045 NZDT; Tue 2145 GMT; Tue 1645 EST)

Consensus Forecast, Unemployment Rate: 5.1%

Consensus Range, Unemployment Rate: 5.0% to 5.1%

A softening job market is expected to lift the jobless rate to 5.1 percent from 4.8 percent in Q3.

South Korea CPI for January (Wed 0800 KST; Tue 2300 GMT; Tue 1800 EST)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.4% to 0.5%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 2.0% to 2.2%

The consensus looks for headline CPI up 0.5 percent on the month and 2.0 percent on the year in January after gains of 0.4 percent and 1.9 percent, respectively, in December.

China PMI Composite for January (Wed 0945 CST; Wed 0145 GMT; Tue 2045 EST)

Consensus Forecast, Services Index: 52.5

Consensus Range, Services Index: 52.4 to 52.5

The consensus sees services improving to 52.5 from 52.2 in December.

France Industrial Production for December (Wed 0845 CET; Wed 0745 GMT; Wed 0245 EST)

Consensus Forecast, M/M: 0%

Consensus Range, M/M: -0.2% to 0.2%

Output is expected flat on the month after a 0.2 percent monthly increase in November.

Germany PMI Composite Final for January (Wed 0955 CET; Wed 0855 GMT; Wed 0355 EST)

Consensus Forecast, Composite Index: 50.1

Consensus Range, Composite Index: 50.1 to 50.1

Consensus Forecast, Services Index: 52.5

Consensus Range, Services Index: 52.5 to 52.5

For the composite, no change is the call from the flash at 50.1. For services, no change from 52.5.

Eurozone PMI Composite Final for January (Wed 1000 CET; Wed 0900 GMT; Wed 0400 EST)

Consensus Forecast, Composite Index: 50.2

Consensus Range, Composite Index: 50.2 to 50.2

Consensus Forecast, Services Index: 51.4

Consensus Range, Services Index: 51.4 to 51.4

The composite is expected unchanged at 50.2 and services unchanged at 51.4.

Eurozone PPI for December (Wed 1100 CET; Wed 1000 GMT; Wed 0500 EST)

Consensus Forecast, Y/Y: 0.0%

Consensus Range, Y/Y: -0.2% to 1.0%

PPI is expected flat on year in December after dropping 1.2 percent in November.

Canada Merchandise Trade for December (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, Balance: -C$0.3 B

Consensus Range, Balance: -C$1.3 B to C$1.2 B

Forecasters expect the trade balance to remain in deficit by C$0.3 billion, unchanged from the prior month.

United States International Trade in Goods and Services for December (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, Balance: -$92.0 B

Consensus Range, Balance: -$98.0 B to -$80.4 B

Trade in goods for December was already reported at a wider than expected $122 billion, up from $104 billion in November. Forecasts for the goods & services deficit look for a big jump in the overall deficit to $92.0 billion from $78.2 billion in November. That translates to weaker GDO for 4Q,

United States PMI Composite Final for January (Wed 0945 EST; Wed 1445 GMT)

Consensus Forecast, Services Index: 52.8

Consensus Range, Services Index: 52.8 to 52.8

No revision from 52.8 for services is the call for the final.

United States ISM Services Index for January (Wed 1000 EST; Wed 1500 GMT)

Consensus Forecast, Index: 54.0

Consensus Range, Index: 52.5 to 55.1

Services business has been robust compared with manufacturing. Another expansionary 54.0 is the call for January services PMI after rising to 54.1 in December from 52.1 in November.

Australia International Trade in Goods for December (Thu 1130 CET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Balance: A$6.75 B

Consensus Range, Balance: A$5.2 B to A$8.5 B

Forecasters expect the merchandise trade balance in a surplus of A$6.75 billion in December after widening to A$7.079 billion in November from A$5.67 in October.

Germany Manufacturing Orders for December (Thu 0800 CET; Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, M/M: 1.8%

Consensus Range, M/M: -1.0% to 3.0%

Consensus Forecast, Y/Y: -10.5%

Consensus Range, Y/Y: -10.6% to -10.5%

Orders are seen rebounding by 1.8 percent on the month after a sharp 5.4 percent decline in December for Germany’s beleaguered factory sector. However, orders are expected down by a nasty 10.5 percent on the year after falling by 1.7 percent in November.

Eurozone Retail Sales for December (Thu 1100 CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.1% to 0.3%

Consensus Forecast, Y/Y: 1.9%

Consensus Range, Y/Y: 1.7% to 2.0%

Sales are expected flat on the month and up a modest 1.9 percent on the year

United Kingdom BoE Announcement & Minutes (Thu 1200 CET; Thu 1100 GMT; Thu 0600 EST)

Consensus Forecast, Bank Rate - Change: -25 bp

Consensus Range, Bank Rate - Change: -25 bp to -25 bp

Consensus Forecast, Bank Rate - Level: 4.5%

Consensus Range, Bank Rate - Level: 4.5% to 4.5%

The consensus sees a 25 basis point rate cut to 4.5 percent as the economy is stalling. Forecasters expect the BOE to signal more rate cuts ahead as the bank updates its economic forecasts.

United States Jobless Claims (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 215K

Consensus Range, Initial Claims - Level: 210K to 218K

Claims sank by 16,000 to a low 207,000 last week and are expected to rebound to 215,000 this week, back above their four-week moving average of 213,000.

United States Productivity and Costs for Fourth Quarter (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate: 1.8%

Consensus Range, Nonfarm Productivity - Annual Rate: 1.0% to 2.2%

Consensus Forecast, Unit Labor Costs - Annual Rate: 3.3%

Consensus Range, Unit Labor Costs - Annual Rate: 1.3% to 3.9%

The first reading on productivity for the fourth quarter is expected to show an annual gain of 1.8 percent compared with 2.2 percent in Q3. Unit labor costs are seen up 3.3 percent versus a small 0.8 percent in Q3.

Japan Household Spending for December (Fri 0830 JST; Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, M/M: -1.4%

Consensus Range, M/M: -2.1% to 0.3%

Consensus Forecast, Y/Y: -0.3%

Consensus Range, Y/Y: -1.0% to 1.5%

Japan's real household spending is forecast to post a fifth straight drop in December, down 0.3 percent on year, as flat growth in real wages amid elevated costs for food and other necessities continued squeezing consumers, following a 0.4 percent dip in November. Lower temperatures supported demand for winter clothing. Forecasts range widely from a 1.0 percent drop to a 1.5 percent gain. On the month, real average expenditures by households with two or more people are expected to fall 1.4 percent after edging up 0.4 percent in November, surging 2.9 percent in October and slumping 1.3 percent in September.

India RBI Rate Announcement (Fri 1x CET; Thu x GMT; Fri x EST)

Consensus Forecast, Bank Rate - Change: -25 bp

Consensus Range, Bank Rate - Change: -25 bp to -25 bp

Consensus Forecast, Bank Rate - Level: 6.25%

Consensus Range, Bank Rate - Level: 6.25% to 6.5%

After opening the liquidity floodgates by an aggressive addition of reserves last week, the RBI will follow up by cutting its repo rate by 25 basis points to 6.25 percent in a bid to revive the economy, its first rate cut in more than four years.

Germany Industrial Production for December (Fri 0800 CET; Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, M/M: -1.0%

Consensus Range, M/M: -2.0% to 0.0%

Consensus Forecast, Y/Y: -2.1%

Consensus Range, Y/Y: -3.5% to -0.6%

Industrial production is expected to fall back at year with output down 1.0 percent on the month in December and down 2.1 percent from a year ago. Output rose 1.5 percent on the month in November rand was down 2.8 percent on year.

Canada Labour Force Survey for January (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Employment M/M: 25,000

Consensus Range, Employment M/M: 14,000 to 50,000

Consensus Forecast, Unemployment Rate: 6.8%

Consensus Range, Unemployment Rate: 6.7% to 6.8%

After a surprising 98,000 rise in December, a more moderate 25,000 increase is the call for January, while the jobless rate ticks up to 6.8 percent from 6.7 percent at year end.

United States Employment Situation for December (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 158,000

Consensus Range, Nonfarm Payrolls - M/M: 125,000 to 225,000

Consensus Forecast, Unemployment Rate: 4.1%

Consensus Range, Unemployment Rate: 4.0% to 4.2%

Consensus Forecast, Private Payrolls - M/M: 140,000

Consensus Range, Private Payrolls - M/M: 95,000 to 200,000

Consensus Forecast, Manufacturing Payrolls - M/M: 5,000

Consensus Range, Manufacturing Payrolls - M/M: -10,000 to 25,000

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.3% to 0.4%

Consensus Forecast, Average Hourly Earnings - Y/Y: 3.8%

Consensus Range, Average Hourly Earnings - Y/Y: 3.7% to 3.9%

Consensus Forecast, Average Workweek: 34.3

Consensus Range, Average Workweek: 34.3 to 34.3

Forecasters expect a decent rise of 158,000 even as winter weather may depress job growth in the January report. Forecasts call for no change in the jobless rate at 4.1 percent.

United States Consumer Sentiment for February (Fri 1000 EST; Fri 1500 GMT)

Consensus Forecast, Index: 72.0

Consensus Range, Index: 69.0 to 73.1

The consensus looks for an uptick to 72.0 in February from 71.1 in January.

United States Wholesale Inventories (Preliminary) for December (Fri 1000 EST; Fri 1500 GMT)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -0.5% to -0.5%

Forecasters expect no revision in the minus 0.5 percent figure from the flash report.

United States Consumer Credit for December (Fri 1500 EST; Fri 2000 GMT)

Consensus Forecast, M/M: $ 16.0 B

Consensus Range, M/M: $7.2 B to $30.3 B

A return to growth is the call with forecasts centering on an increase of $16.0 billion in December after a surprise decline of $7.5 billion in November.

|