|

The Week Ahead: Highlights

Europe Preview

Back to Negative Rates in Switzerland?

By Marco Babic, Econoday Economist

The highlight on the European Calendar in the week ahead is

the Swiss National Bank interest rate decision announcement on Thursday. After

lowering its benchmark rate to zero following its meeting in June, the SNB is

weighing a return to negative interest rates. Since raising rates from 1.5

percent in June 2023 to 1.75 percent, the central bank has been cutting rates

steadily since then, mostly be 25 basis point increments except for December

when it cut them from 1.0 to 0.5 percent.

With that in mind, a possible scenario is another reduction of 25 basis points

to minus 0.25 percent. With inflation pretty much non-existent in Switzerland

-- CPI fell 0.1 percent in August month-on-month and rose a paltry 0.2 percent

year on year - the SNB isn't burdened by inflationary concerns. Of greater

import is a slowing economy and, while the SNB may not comment on it directly,

the effect that US tariffs of 39 percent are having. Last week, trade data for

August showed a contraction in the Swiss trade surplus to 4.0 billion Swiss

Francs from 4.62 billion in July. The surplus with the US shrank to 2.06

billion Francs from 2.93 billion in July. Particularly hard hit has been the

chemical and pharmaceutical industries and watch exports.

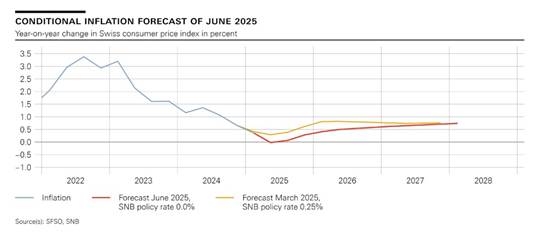

On the positive side, the SNB doesn't have to pencil a stagflation scenario

into its calculations and can address the slowing economy and Swiss Franc

strength. In its June forecast, the central bank also doesn't see inflation

heating up in the next two years. It is, if you can call it that, a luxury to

have.

The downside of negative rates is that if they venture too far into negative

territory, banks might have to pay to have their funds held at the SNB. The

last time rates were negative, the SNB gave banks an exemption to a certain

threshold. One would expect to have the same policy in place for the sequel.

Still, that would cost banks money, potentially burdening another major sector

of the economy.

Will the Upswing in PMI Results Continue?

Next week sees the release of preliminary PMI results for September which will

be watched to see if some tentative steps into expansion that were seen in

August continue. For the Eurozone, sentiment stood at 51.0 for the composite

index in August, with manufacturing at 50.7 and services at 50.5. Along with

the Eurozone, France and Germany report their results on Tuesday.

Germany's closely watched Ifo survey for September is scheduled for Wednesday.

Business expectations improved in August, gaining to 91.6 from 90.8 in August,

while the climate component was 89.0 after 99.6. Current conditions marginally

deteriorated to 86.5 from 86.5. The Ifo and PMI indexes could give some

indications that businesses are learning to live with US tariffs.

Consumers in the Eurozone, Germany, and Italy will weigh in with their views

next week, the currency bloc and Italy reporting September sentiment and

Germany's Gfk reporting October results. All three reported weaker consumer

sentiment from the corresponding prior month, and there are no indications that

consumers will suddenly be more positive. They are instead likely to remain

cautious and opt to save if they can rather than spending on things other than

necessities.

US Preview

Home Sales Data Back in Spotlight

By Theresa Sheehan, Econoday Economist

With the September 16-17 FOMC meeting out of the way, the

focus will shift back to the economic data in the September 22 week.

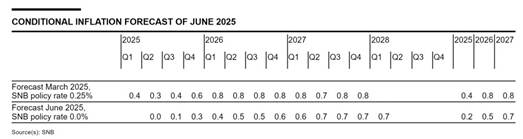

The third and final estimate of second quarter GDP is set

for 8:30 ET on Thursday. It isn't particularly important in itself; however,

the report will also include annual benchmark revisions. Overall, the path of

growth in the past few years should not look very different but there will be

some changes.

While of interest, the data is in the rear view. At this

stage the third quarter 2025 is well advanced and there is sufficient data to

start shaping forecasts. Most of the three district bank GDP nowcasts are only

just finishing for the second quarter. The New York Fed's Staff Nowcast does

include the third quarter and looks for growth of 2.16 percent.

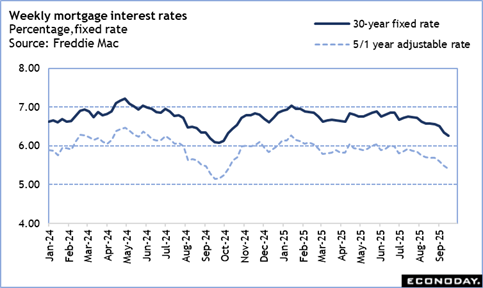

The week includes the August data on sales of new

single-family homes at 10:00 ET on Wednesday and existing home sales at 10:00

ET on Thursday. Note that the NAR changed the original release date of Tuesday

in order to accommodate the observance of Rosh Hashanah.

Weakening in the labor market will mean that potential

homebuyers have become more cautious about committing to big purchases, of

which a home is one of the biggest. Sales of new homes - which are counted when

the contract is signed - could benefit from the decline in mortgage rates seen

in August. Sales of existing homes may get some support from increasing

inventories and decreasing prices. However, the data - which counts contracts

closed - is for sales using mortgages generally taken out a month or two

earlier when mortgage rates were higher.

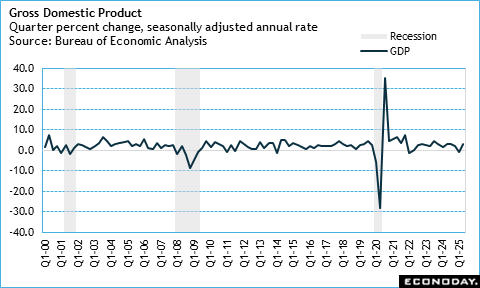

The Freddie Mac average weekly rate for a 30-year fixed rate

mortgage was at its recent peak of 6.86 percent in the June 19 week and has

been falling from there, albeit unevenly. The rate was as low as 6.72 percent

in the July 10 and July 31 weeks and reached a low of 6.56 percent in the

August 28 week. In a good sign for future sales, the rate is down to 6.26

percent in the September 18 week and the lowest since 6.12 percent in the

October 3, 2024 week.

The MBA weekly report on mortgage applications shows that

many homebuyers and refinancers are opting for adjustable-rate mortgages,

probably as a way to keep initial monthly payments lower or to substantially

reduce current monthly payments. The Freddie Mac weekly average rate for a

5/1-year ARM was at 6.01 percent in the June 19 week, and also charting an

uneven path lower. It was down to 5.80 percent in the July 10 week and 5.85

percent in the July 31 week. The rate is down to 5.41 percent in the September

18 week and the lowest since 5.41 percent in the October 10, 2024 week.

The Week Ahead: Econoday Consensus Forecasts

Monday

China Loan Prime Rate for September (Mon 0900 CST;

Sun 0100 GMT; Sun 2100 EDT)

Consensus Forecast, 1-Year Rate - Change: 0 bp

Consensus Range, 1-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 1-Year Rate - Level: 3.00%

Consensus Range, 1-Year Rate - Level: 3.00% to 3.00%

Consensus Forecast, 5-Year Rate - Change: 0 bp

Consensus Range, 5-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 5-Year Rate - Level: 3.50%

Consensus Range, 5-Year Rate - Level: 3.50% to 3.50%

The consensus looks for no change this time on both 1-year

and 5-year LPR.

Eurozone EC Consumer Confidence Flash for September (Mon

1600 CEST; Mon 1400 GMT; Mon 1000 EDT)

Consensus Forecast, Index: -15.0

Consensus Range, Index: -15.6 to -14.8

Confidence seen at minus 15.0 in the September flash.

Tuesday

Singapore CPI for August (Tue 1300 SGT; Tue 0500 GMT;

Tue 0100 EDT)

Consensus Forecast, M/M: 0.7%

Consensus Range, M/M: 0.3% to 0.7%

CPI is expected to rise 0.7 percent from a year ago in

August compared with an increase of 0.6 percent on the year in July.

Germany PMI Composite Flash for September (Tue 0930

CEST; Tue 0730 GMT; Tue 0330 EDT)

Consensus Forecast, Composite Index: 50.1

Consensus Range, Composite Index: 50.1 to 50.5

Consensus Forecast, Manufacturing Index: 50.0

Consensus Range, Manufacturing Index: 49.9 to 50.0

Consensus Forecast, Services Index: 49.5

Consensus Range, Services Index: 49.1 to 49.9

The consensus looks for the PMI composite at 50.1 for

September versus 50.5 in the August final. PMI manufacturing expected at 50.0

for September versus 49.8 in the August final. Services index seen at 49.5 in

September versus 49.3 in in the August final.

Eurozone PMI Composite Flash for September (Tue 1000

CEST; Tue 0800 GMT; Tue 0400 EDT)

Consensus Forecast, Composite Index: 50.9

Consensus Range, Composite Index: 50.6 to 50.9

Consensus Forecast, Manufacturing Index: 50.7

Consensus Range, Manufacturing Index: 50.0 to 51.0

Consensus Forecast, Services Index: 50.5

Consensus Range, Services Index: 50.4 to 50.9

The consensus looks for the PMI composite almost unchanged

at 50.9 for September versus 51.0 in the August final. Manufacturing expected

flat at 50.7 for September versus 50.7 in the August final. Services seen at

50.5 in September versus 50.5 in in the August final.

United States Current Account for Second Quarter (Tue

0830 EDT; Tue 1230 GMT)

Consensus Forecast, Balance: -$302.0 B

Consensus Range, Balance: -$380.0 B to -$256.0 B

The consensus sees the deficit narrowing to $302.0 billion

in Q2 from $450.2 billion in Q1 with the shrinkage in the trade deficit.

United States PMI Composite Flash for September (Tue 0945

EDT; Tue 1345 GMT)

Consensus Forecast, Manufacturing Index: 52.0

Consensus Range, Manufacturing Index: 51.5 to 53.0

Consensus Forecast, Services Index: 53.5

Consensus Range, Services Index: 53.0 to 54.5

Forecasters see manufacturing growth marginally slower at 52.0

in the September flash versus 53.0 in the August final. Services expected slightly

slower too at 53.5 versus 54.5 in August.

United States Richmond Fed Manufacturing Index for

September (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast, Index: -10

Consensus Range, Index: -10 to -4

The index is expected to erode to minus 10 in September from

minus 7 in August.

Wednesday

Australia Monthly CPI for August (Wed 1130 AET; Wed 0130

GMT; Tue 2130 EDT)

Consensus Forecast, CPI - Y/Y: 2.9%

Consensus Range, CPI - Y/Y: 2.4% to 3.3%

CPI expected at 2.9 percent on year in August versus 2.8

percent in July. The report is a key input for the Reserve Bank of Australia

interest rate decision the following week.

Germany Ifo Survey for September (Wed 1000 CEST; Wed 0800

GMT; Wed 0400 EDT)

Consensus Forecast, Business Climate: 89.1

Consensus Range, Business Climate: 88.5 to 89.5

Consensus Forecast, Current Conditions: 86.4

Consensus Range, Current Conditions: 86.0 to 86.8

Consensus Forecast, Business Expectations: 91.7

Consensus Range, Business Expectations: 91.3 to 92.0

Business climate expected almost unchanged at 89.1 versus

89.0 in the prior month. Current conditions seen flat at 86.4 and expectations

at 91.7 versus 91.6.

United States New Home Sales for August (Wed 1000 EDT;

Wed 1400 GMT)

Consensus Forecast, Annual Rate: 649K

Consensus Range, Annual Rate: 625K to 680K

Sales are going nowhere at an annual 649K rate in August

versus 652K in July.

Thursday

Germany GfK Consumer Climate for October (Thu 0800 CEST;

Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, Index: -23.0

Consensus Range, Index: -23.8 to -22.0

The consensus looks for the consumer sentiment index at minus

23.0 in October versus minus 23.6 in September.

Switzerland SNB Monetary Policy Assessment for September (Thu

0930 CEST; Thu 0730 GMT; Thu 0330 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: -25 bp to 0 bp

Consensus Forecast, Level: 0.0%

Consensus Range, Level: -0.25% to 0.0%

Expectations call for the SNB to keep rates steady at zero after

cutting by 25 bp last time.

Eurozone M3 Money Supply for August (Thu 1000 CEST; Thu

0800 GMT; Thu 0400 EDT)

Consensus Forecast, Y/Y - 3-Month Moving Average: 3.3%

Consensus Range, Y/Y - 3-Month Moving Average: 3.2%

to 3.6%

Money growth expected down at 3.3 percent in August versus

3.5 percent in July.

United States Durable Goods Orders for August (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, New Orders - M/M: -0.5%

Consensus Range, New Orders - M/M: -1.6% to 4.3%

Consensus Forecast, Ex-Transportation - M/M: -0.2%

Consensus Range, Ex-Transportation - M/M: -1.0% to

0.1%

Volatile aircraft orders continue to make the headline

figure a wild card. Total durable goods orders are seen showing a decrease of 0.5

percent on the month in August and a decline of 0.2 percent ex-transportation

orders.

United States GDP for Second Quarter (Thu 0830 EDT; Thu

1230 GMT)

Consensus Forecast, Quarter over Quarter - Annual Rate:

3.3%

Consensus Range, Quarter over Quarter - Annual Rate: 3.3%

to 3.5%

The final revision for Q2 growth is expected to show no

change from 3.3 percent in the last report.

United States International Trade in Goods (Advance) for

August (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Balance: -$94.4 B

Consensus Range, Balance: -$96.0 B to -$93.0B

The consensus sees the goods trade gap at $94.4 billion in

August versus $103.9 billion in July.

United States Jobless Claims for Week 9/20 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 238K

Consensus Range, Initial Claims - Level: 226K to 240K

Claims are seen at 238K in the latest week versus 231K in

the prior week. What a relief to see claims back around 240K after a short

period around 260K.

United States Wholesale Inventories (Advance) for August (Thu

0830 EDT; Thu 1230 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -0.1% to 0.2%

The consensus sees the flash report for wholesale

inventories up 0.1 percent.

United States Existing Home Sales for August (Thu 1000

EDT; Thu 1400 GMT)

Consensus Forecast, Annual Rate: 3.95 M

Consensus Range, Annual Rate: 3.90 M to 4.0 M

Sales expected to stay soft at a 3.95 million rate in August

versus 4.01 million in July.

Friday

Japan Tokyo CPI for September (Fri 0830 JST; Thu 2330

GMT; Thu 1930 EDT)

Consensus Forecast, CPI - Y/Y: 2.6%

Consensus Range, CPI - Y/Y: 2.3% to 2.8%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.6%

Consensus Range, Ex-Fresh Food - Y/Y: 2.2% to 2.8%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.1%

Consensus Range, Ex-Fresh Food & Energy - Y/Y:

2.8% to 3.1%

Italy business and Consumer

Confidence for September (Fri 1000 CEST; Fri 0800 GMT; Fri 0400 EDT)

Consensus Forecast, Consumer Confidence: 96.5

Consensus Range, Consumer Confidence: 96.0 to 96.5

Consumer confidence seen at 96.5 in September versus 96.2 in

August.

Canada Monthly GDP for August (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.2%

The consensus agrees with the Stats Canada preliminary

estimate that sees GDP up 0.1 percent on the month.

United States Personal Income and Outlays for July (Fri

0830 EDT; Fri 1230 GMT)

Consensus Forecast, Personal Income - M/M: 0.3%

Consensus Range, Personal Income - M/M: 0.3% to 0.4%

Consensus Forecast, Personal Consumption Expenditures -

M/M: 0.4%

Consensus Range, Personal Consumption Expenditures - M/M:

0.3% to 0.5%

Consensus Forecast, PCE Price Index - M/M: 0.3%

Consensus Range, PCE Price Index - M/M: 0.2% to 0.3%

Consensus Forecast, PCE Price Index - Y/Y: 2.7%

Consensus Range, PCE Price Index - Y/Y: 2.6% to 2.8%

Consensus Forecast, Core PCE Price Index - M/M: 0.2%

Consensus Range, Core PCE Price Index - M/M: 0.2% to

0.3%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.9%

Consensus Range, Core PCE Price Index - Y/Y: 2.9% to

3.0%

On the month, personal income is expected up 0.3 percent

with nominal spending up a moderate 0.4 percent, both suggesting consumer

resilience. PCE prices are seen up 0.3 percent with core up 0.2 percent. The

consensus sees the PCE prices up 2.7 percent on year and core PCE prices up 2.9

percent on year.

United States Consumer Sentiment for September (final) (Fri

1000 EDT; Fri 1400 GMT)

Consensus Forecast, Index: 55.4

Consensus Range, Index: 55.4 to 56.0

Consensus Forecast, Year-ahead Inflation Expectations:

4.8%

Consensus Range, Year-ahead Inflation Expectations: 4.8%

to 4.8%

Forecasters see no revision from the preliminary readings

with the sentiment index unchanged at 55.4 and inflation expectations unrevised

at 4.8 percent.

|